Yesterday (July 16) saw Turkey institute record-breaking increases on fuel taxes, the latest in a series of price increases in recent weeks. The price for a liter of gasoline in the Istanbul metropolis increased from 28 Turkish Lira ($1.07) to 34 ($1.29) with the change. In an announcement from the Ministry of Revenue and Finance related to the price hike, the ministry contested that despite the increase, “Prices for gasoline and diesel remain the fourth cheapest among European countries.”

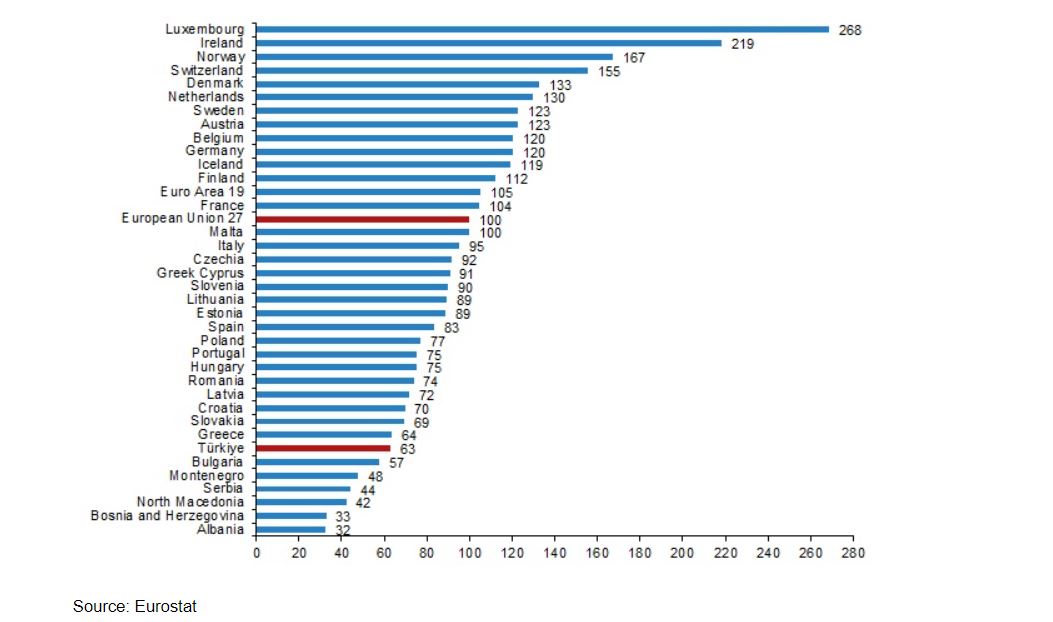

Purchasing power lags behind European countries

The announcement from the Ministry of Revenue and Finance ignores the fact that Turkey’s minimum wage lags far behind most European countries, resulting in a low purchasing power that makes fuel prices for ordinary Turks in fact significantly more expensive than for their European neighbors. Turkey’s gross minimum wage, currently set at about 454 Euro per month, is enough to purchase some 349 liters of gasoline based on the tax hike announced by the Ministry of Revenue and Finance yesterday. In Germany, the minimum wage is enough to buy some 972 litres of gasoline based on local prices. Move to France, this number drops to 919 based on local minimum wage and gas prices. In Turkey’s neighboring Greece, a month’s minimum wage buys you 445 liters of gasoline, a significant decrease from most western European states but still over 25% more than a Turkish minimum wage earner. Poland and Croatia boast similar numbers to Greece, still above Turkish purchasing power.

The search for foreign funds

Turkey’s foreign exchange reserves dropped into negative territory in May, following several months in which the country’s central bank spent large sums propping up the Turkish Lira in the lead up to presidential and parliamentary elections that month. Shortly before the presidential runoff election on May 28, President Recep Tayyip Erdoğan announced that Turkey would receive funding from Gulf states in order to replenish the central bank’s foreign reserves, an announcement that lacked specific details but signalled a potential warming in relations with several deep-pocketed Gulf states that have been strained in recent years. In June, President Erdoğan visited the United Arab Emirates and was filmed exiting a restaurant in Abu Dhabi hand-in-hand with the country’s leader Sheikh Mohammed bin Zayed bin Sultan Al Nahyan. On July 14, it was announced that President Erdoğan would join a series of business forums this month held in Jeddah, Doha, and Abu Dhabi, another sign of warming ties in the region. While Qatar has remained a strong ally of Turkey, relations between Ankara, Saudi Arabia, and the UAE have been strained for the past decade amidst significant differences during the Arab Spring and subsequent conflicts in the region. Erdoğan’s recent rapprochement with these states has been interpreted in part as a sign that the leader is on the hunt for foreign reserves following an election cycle that heavily depleted those at the Turkish Central Bank.

Refugee deal with the United Kingdom

A possible refugee deal with the United Kingdom has also emerged in recent days as a source for foreign funds. Some 1000 migrants originating in Turkey have reportedly crossed to the United Kingdom since the beginning of the year via the English Channel, an increase from recent years attributed to early February’s devastating earthquake centered in Turkey’s southeast. The British government is reportedly in talks with Ankara to sign an agreement aimed at stemming this flow of migrants from Turkey. A recent Guardian report indicated that the British government has sent some 3 million British Pounds to Ankara since 2019 aimed at controlling irregular emigration from Turkey. As a new deal looms, the potential of such a deal to bring in much needed foreign reserve funds has also come into focus.

Return to economic orthodoxy

Since President Erdoğan’s reelection in late May, many had predicted a return to orthodox economic policies following years of soaring inflation exacerbated by low interest rates, a hallmark of Erdoğan’s economic approach. Following his electoral victory, Erdoğan hired Mehmet Şimsek as Treasury and Finance Minister. Şimşek had previously served in the role from 2009-2015 and earned respect in international banking circles, leading many to believe that his appointment signalled a return to more orthodox economic policies.

The road back to orthodoxy, however, has been rocky. An interest rate hike last month from 8.5% to 15% fell short of expectations of a figure in the 20-40% range that many international financial institutions had expected. The value of the Lira, meanwhile, has plummeted from around 20 to the US Dollar on the eve of May’s runoff presidential election to around 26 the greenback today. Şimşek’s moves as economic boss so far have been criticized as lacking transparency and a detailed macroeconomic program. The degree of autonomy enjoyed by Şimşek from Erdoğan himself has also been called into question by many, even as the president has dropped his long-standing opposition to raising interest rates.

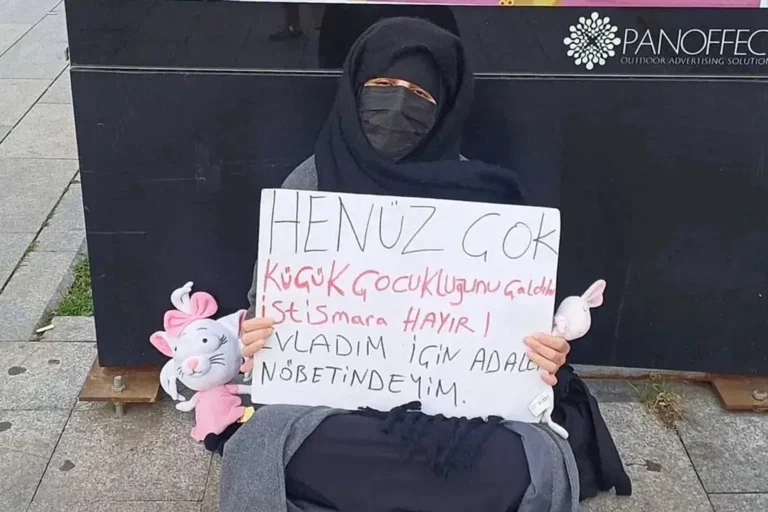

Furthermore, the recent flurry of tax hikes have been criticized as regressive, placing unequal burden on Turkey’s lower- and middle-income earners while failing to address the country’s deepening economic inequality, which ranks among the most unequal of all OECD countries. Recent hikes to basic necessities such as bread, natural gas, and basic consumer items have affected these groups disproportionately. In a recent piece for Medyascope analyzing Turkey’s attempt to overcome its economic crisis, economist Öner Günçavdı wrote “These measures do not address economic justice and place the burden on the incomes of low and middle-income people. Such policies have distorted the existing income distribution in the country in favor of high-income people.”

Written for Medyascope by Leo Kendrick